Employee Loan Agreement: Meaning, Objective, Eligibility & Procedure

As an employee, you may have found yourself in a situation where you need to borrow money from your employer. If this is the case, it is vital to have a clear understanding of the terms and conditions of the loan, as well as your rights and responsibilities as a borrower. It is where an employee loan agreement comes in. An employee loan agreement is a contract or agreement between employer & employee that defines the terms as well as conditions of the loan made by the employer to the employee. In this blog post, we will dig out the meaning and significance of an employee loan agreement, so you can make informed decisions about borrowing money from your employer.

Meaning of Employee Loan Agreement

An employee loan agreement is a beneficial arrangement between employers and workers that enables the latter to borrow funds for income-producing purposes. To obtain a loan, employees must adhere to all of the guidelines outlined in the loan agreement[1], which must be in writing. Typically, loans have low-interest rates and are repaid in instalments from the employee’s paychecks. Employers may use an automatic payroll deduction contract to guarantee loan repayment. Employee loans are often made for long-term investments such as purchasing a car or house, and there are various template options available to business owners. To finalize the agreement and ensure both parties understand the terms and conditions, the employee must sign the loan agreement. As a legal contract, the employee loan agreement creates the necessary framework for the loan.

Objectives

By having a written agreement, both the employer and employee can refer to it if there are any uncertainties or disputes related to the loan. An employee loan agreement template aids in building trust and establishing transparency between the two parties engrossed in the loan process. A template for an employee loan agreement is used to make sure that the conditions of a loan are well-defined and agreed upon by both the employee and employer. This agreement ensures that both parties benefit by outlining several significant aspects of the loan, such as repayment schedule, interest rate, and consequences resulting from non-payment. A written contract assists in resolving uncertainties or difficulties that may arise during payment. Thus, this template promotes honesty and fairness between those involved in borrowing or lending funds at a workplace. The payment amount, interest rate, charges for late payment, and any other relevant fees should all be quoted in the payment schedule.

Eligibility for a Loan

The ability of an employee to obtain a loan is contingent upon the lending institution’s regulations and stipulations. The eligibility for a loan demands the conditions mentioned below-

- The employee should have a good credit score.

- The individual must have been employed for half a year, minimum.

- The employee should provide proof of residence.

- The employee needs to have a consistent and steady flow of income and the potential to repay the loan.

- The employee should have a valid bank account.

- The employee should present valid identification.

- The employee should meet the requirements set by the lending institutions.

- The employee needs to be of legal age.

- The maximum amount of loans are for a specified objective. An employee may take a loan for marriage, a vehicle purchase, or a medical emergency.

Eligibility Amount & Repayment

- The loan amount approved will be in the same line as the employee’s gross salary.

- HR and Finance/Management Head will approve the loan request after the request is made.

- A cheque will be issued in the name of the employee, or money will be credited to the bank a/c of the employee. Payment to third parties is not allowed.

- Repayment of the loan will take place via monthly deductions from the salary amount over a set time frame.

- Employees may reach out to HR for loan disbursal. The deduction will take place in instalments from their salary.

- After loan approval, the deductions in instalments will take place.

- Loan balance repayment should be brought into the knowledge of HR.

- No penalty is imposed for prepayments.

- The employee may proceed ahead with applying for one loan at a time or even a new loan while still repaying a previous loan amount.

- After making the payment for previous loans, the employee may apply for another loan a year.

- Loans sanctioned for a specific objective can be used with the written agreement of the management.

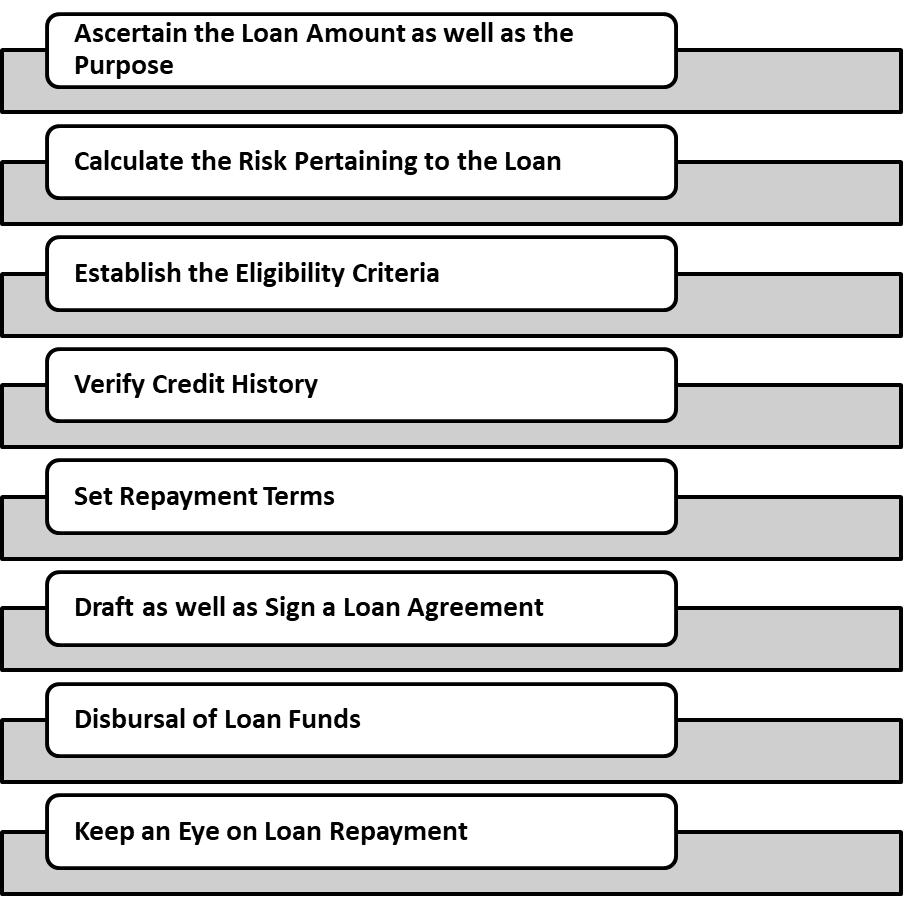

Employee Loan Agreement: Procedure

- Ascertain the loan amount as well as the purpose

Estimate the loan amount an employee needs and the objective for which it must be used. - Calculate the Risk Pertaining to the Loan

Find out the potential risks linked with granting a loan to an employee. - Establish the Eligibility Criteria

Set eligibility requirements for employees to receive loans, such as employment tenure and credit score. - Verify Credit History

Check the credit history of the employee and other financial details to calculate the risk of granting the loan. - Set Repayment Terms

Establish the repayment terms related to the loan, entailing the repayment period as well as the interest rate. - Draft as well as Sign a Loan Agreement

The loan agreement is to be signed between the employer & Employee. - Disbursal of Loan Funds

Disburse the loan amount to the Employee following the loan agreement. - Keep an Eye on Loan Repayment

Monitor the loan repayment in order to ensure that the Employee is complying with the repayment terms.

The Final Words

An employee loan agreement is all about an agreement that takes place between an employee and an employer, which entails an employer regarding a grant of loan to an employee, which can be deducted in instalments from the employee salary. Get in touch with a recruitment consulting firm that offers IT recruitment services, and you can obtain an employee loan agreement template in a hassle-free manner.

Read our Article: How to Create an Employee Retention Program for your Company?