Full and Final Settlement: Components and Activities Involved

The process of paying out an employee’s entire payable amount after retirement, termination, or resignation from an organisation is known as full and final settlement. The FnF settlement process includes deductions, bonuses, and other items in addition to the salary for the previous month. Because of this, the procedure calls for a high level of knowledge and experience. You can find all the significant & relevant information you need about the Full and Final settlement in this article, including the main components, activities, legal requirements, payment schedule, and more.

What is the Full and Final Settlement?

The corporate world was severely affected by the Coronavirus[1]. We saw several trends occurring within the organisation, such as moonlighting and the great resignation that has mostly escalated at a never-before-seen rate. Several underlying issues, such as dissatisfaction, low income, and a lack of opportunities at work, can be linked to these organisational trends. However, in the middle of all this commotion, if there is one thing that employees looked forward to, it was their Full and Final Settlement from the company. During different stages of an employee’s career, getting paid for their efforts when about to leave an organisation is quite important. On the other side, it is equally crucial for employers to handle the required processes to make sure that their employees can leave without any difficulty.

Full and Final Settlements, also referred to as FnF settlement, is the process that every employer must do if any employee has been fired, retired, or resigned from their position. Calculating the FnF settlement takes skill, in-depth knowledge, and appropriate guidelines. You should be aware of the following additional details regarding the FnF procedure:

- Different organisations may have varied FnF settlement policies.

- It could also consist of feedback questionnaires or exit interviews, which help employers identify the company’s strengths and weaknesses.

- The Full and Final settlement is also helpful for tracking the resources and a few more benefits awarded to a worker and recovering possession of them before their last day of employment.

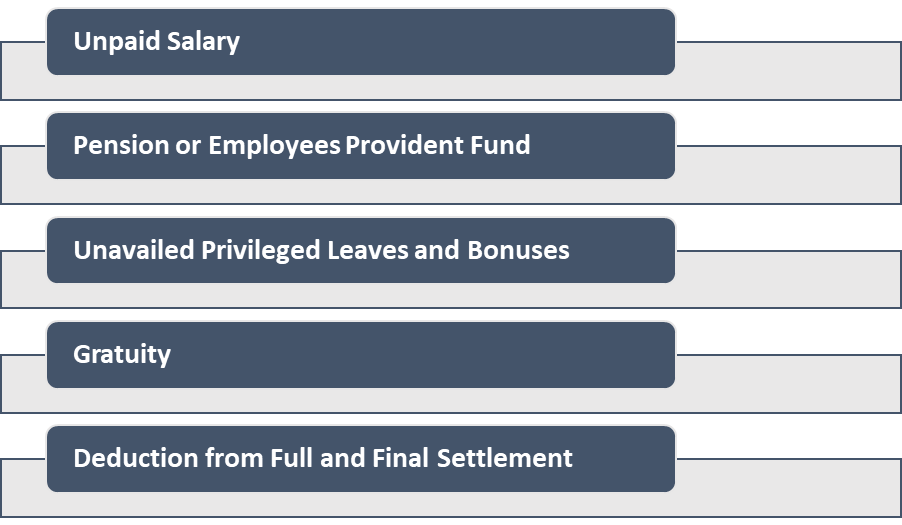

Components

- Unpaid Salary: The law mandates that employers pay their employees’ salaries for the previous month by the seventh or tenth of the following month. The employer must, however, calculate the payable compensation up to the time the letter of resignation was submitted when an employee decides to leave his position. Moreover, annual benefits paid to employees, such as LTA and other arrears, are included in the last monthly salary. The final computation is always based on the full and final settlement policies of the companies and the government.

- Pension or Employees Provident Fund: Some major corporations deduct a portion of an employee’s monthly payment and deposit it in the employee’s provident fund account. The employer uses the same portion of his monthly pay to create a fund for the future. Similarly to this, some businesses have employee pension plans that provide a certain sum of money when a person retires. When an employee decides to quit, his PF must be calculated during the FnF settlement process along with the previous month’s salary. Moreover, the retirement amount, PF, and salary from previous months are determined during retirement.

- Unavailed Privileged Leaves and Bonuses: In addition to making use of the organization’s casual leave policy, employees may also be granted privileged or earned time off during their employment. Depending on the organisation, a number of leaves may be available, which the employee may cash in before leaving. Once more, different organisations may have different policies regarding the terms and conditions of leave encashment. Some businesses also give out bonuses for exceptional work and special events. These leaves’ cash encashment must also be taken into account while settling FnF.

- Gratuity: A benefit provided by the employer to its employees who have worked there for at least four years is known as a gratuity. At the expiration of this period, an employee who decides to leave or is fired from their position is entitled to a gratuity award within one month of leaving or being fired. The employer must pay interest if the gratuity payment is not made under the terms of an FnF settlement within 30 days.

- Deduction from Full and Final Settlement: Any tax liabilities associated with the Full and Final settlement are added to the overall amount for employees under full and final settlement law. For example, employers are required by the Income Tax Act of 1961 to deduct TDS from the total amount.

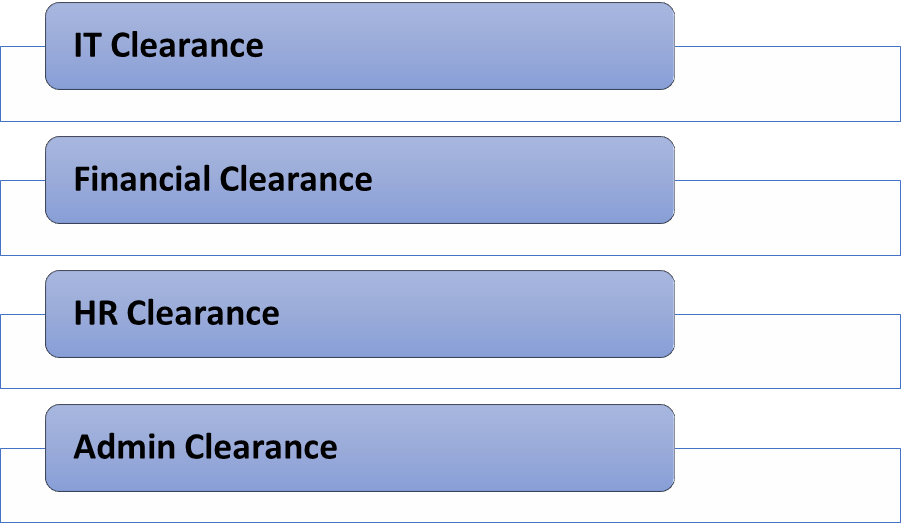

Activities Involved in the Full and Final Settlement Process

The full and final settlement also includes approvals from several departments, including administration, human resources, finance, and IT. Also, it’s crucial to consider which components to include and explode when figuring out the Full and Final settlement. Let’s examine each activity in greater detail:

- IT clearance: The employee is required to return all company-provided technical items, such as a mobile phone, laptop, keyboard, etc., to receive IT clearance. These goods must be returned on his last day of employment or by a deadline set by the IT department. As you were the owner of the assets, any damage or breakage during your employment will result in a deduction of a certain amount from your Full and Final settlement amount.

- Financial clearance: While determining the full and final settlement for the financial clearance, the employer must take into account all cases concerning money, such as pensions, provident funds, leave encashments, gratuities, unpaid wages, and more. As it requires calculations, it is one of the clearances that take the longest of all clearances.

- Admin clearance: For admin clearance, the employee must present his employee ID cards and other specific materials that grant him direct access to the company. You must complete these requirements before leaving the company to stop any unauthorised access to the office campus.

Full and Final Settlement Payslip Format

The Full and Final settlement letter is issued regarding the employee’s resignation letter that was submitted. The FnF letter has no set format, and occasionally businesses will just prepare a payslip in its place. The payslip should include the information below:

Name of Employee, Employee ID, Date of Resignation, Reason for Resignation, Reason for Leaving, and Specifics of FnF Settlement Amount

When Does the Full and Final Settlement Actually Take Place?

It is crucial to remember that an employee has the right to have all dues settled within a fair timeframe, whether they are quitting their job or getting fired. It is customary to complete the process within 30 to 45 days after the employee’s last day of employment. The employee may file a lawsuit against the employer if it doesn’t follow the Full and Final settlement guidelines, and as a result, the employer will be forced to pay interest on all dues.

Conclusion

Every organisation follows a meticulous and organised process for Full and Final Settlement. When done correctly, it results in a smooth exit and aids employers in averting future financial difficulties. In a perfect scenario, HR departments would coordinate various FnF-related tasks between all parties involved and, if necessary, resolve any conflicts before the end of the working week. Looking for a simplified Full and final settlement solution? Get in touch with our Corphr team. As we provide holistic IT recruitment services and a wide range of solutions, we will make your FNF settlement process easier.

Read our Article: The Great Resignation: Meaning, Causes, and Impact