Compliance Manager Job Description, Roles & Responsibilities

Compliance managers are professionals who ensure that companies adhere to their industry’s ever-changing laws and regulations. These experts are responsible for ensuring that their employers are in compliance with rules at all times to avoid legal disputes, penalties, and reputational damage. In this blog post, we will cover the essential roles and responsibilities of a compliance manager job description. Whether you are considering a career as a compliance manager, looking forward to hiring a competent compliance manager or simply want to understand more about what they do, read on to learn about the critical functions of this profession.

What is a Compliance Manager?

A compliance manager is a crucial role within an organization responsible for ensuring that the company operates within ethical and regulatory standards. With a keen eye for detail, Compliance Managers perform periodic internal reviews and audits to guarantee full compliance with all relevant regulations and specifications. They also develop and implement company policies, oversee control systems to prevent legal violations or breaches of company policies, and draft regulatory compliance documentation. Balancing legal compliance with business goals is one of the many challenges faced by a Compliance Manager, making collaboration with other departments essential. Furthermore, they support health and safety regulations, mitigate legal risks and liabilities, and stay ahead of the curve with trends in compliance management. In summary, the role of a Compliance Manager is multifaceted and critical to ensuring a company operates with integrity and within the law.

Job Description

- Perform regular internal evaluations or assessments.

- Evaluate adherence to product standards or potential operational hazards and create plans to mitigate those risks.

- Investigate or direct compliance issues

- Make sure that all members of the organization are aware of written policies and procedures through effective communication.

- Find any conformity problems that need to be addressed.

- Assess the methods used for ongoing supervision of testing.

- Submit regulatory-compliant reports to the relevant authorities.

- Check and supervise the processes of surveillance and supervision.

- It is advisable to seek advice from an attorney in order to ensure adherence to regulations and laws

- Document compliance activities

- Research emerging compliance issues

- Provide guidance to top-level executives and industry partners regarding the implementation of conformity initiatives.

- Work together with the senior executives and relevant department leaders.

- Train employees on compliance topics

- Help outside auditors or carry out audits within the organization.

- Provide a detailed account of the compliance program to the management and the Board of Directors.

- Assess the ongoing observation and recording of systems on a regular basis.

- Report compliance violations

Difference between Compliance Manager and Risk Manager

In any organization, compliance and risk management are crucial for ensuring smooth operations and avoiding potential legal and financial issues. However, many people often confuse the roles of a compliance manager and a risk manager, assuming they are the same thing. Although they share some similarities, there are key differences that set them apart. Let’s have a look at the distinctions between a compliance manager and a risk manager and how each role contributes to an organization’s success.

- Compliance and risk management are closely aligned but have different end goals.

Compliance and risk management are two crucial functions in any organization. While they are closely aligned, they have different end goals. Compliance focuses on meeting established rules and regulations to ensure regulatory adherence, while risk management identifies and mitigates risks to ensure overall organizational success. Compliance is necessary for meeting current regulations, while risk management must consider potential future risks. It is important to note that while compliance is a critical component of risk management, risk management encompasses a broad range of risks beyond regulatory compliance. Therefore, a successful risk management strategy must consider compliance while not being limited by the siloed nature of compliance. Ultimately, both compliance and risk management are instrumental in protecting and promoting the success of any organization. - Compliance focuses on meeting established rules and regulations, while risk management identifies and mitigates risks.

As discussed earlier, compliance and risk management are two closely related functions that serve different goals. Compliance prioritizes adherence to established regulations and guidelines, whereas risk management aims to identify and mitigate any possible risks the organization may face. A compliance manager is responsible for ensuring that the organization meets all regulatory requirements and follows industry standards, while a risk manager proactively identifies and assesses risks and develops strategies to mitigate or eliminate them. While compliance deals with known regulations, risk management involves identifying potential threats that may arise in the future. Therefore, both functions are crucial for the protection and success of an organization, working in tandem to achieve the organization’s objectives while minimizing potential risks. - Compliance addresses known regulations, while risk management must also consider potential future risks.

Compliance focuses on meeting established rules and regulations, while risk management takes a broader view by identifying and mitigating risks, both known and potential. Compliance addresses known regulations, but risk management must also consider potential future risks that could affect the organization. It means that risk management requires a proactive approach, where the identification of risk factors and the development of mitigation strategies must be ongoing processes integrated into the organization’s culture. Compliance is necessary for regulatory adherence, but risk management is essential for overall organizational success. By considering potential future risks, organizations can develop robust risk management plans that help them navigate uncertainties and ensure that they remain successful in the long term. Ultimately, both compliance and risk management are crucial for the protection and success of any organization. - Risk management should be a separate and independent function from the audit organization.

In the previous sections, we discussed the differences between compliance and risk management and how they are essential functions within an organization. One critical aspect of effective risk management is that it should be a separate and independent function from the audit organization. This separation ensures the risk management team can maintain an objective view and exercise full autonomy in identifying and mitigating risks. When risk management is integrated with the audit function, it may lead to inherent conflicts of interest and partial decision-making. Therefore, it is important that risk management operates independently and reports to a separate senior manager to ensure clear governance. This separation also helps to streamline risk management practices and enhances the overall effectiveness of the organization’s risk management approach. By maintaining an independent risk management function, organizations can effectively manage risks and protect themselves from potential threats while ensuring regulatory compliance. - Compliance is necessary for regulatory adherence, while risk management is necessary for overall organizational success.

One thing that is clear from an examination of compliance and risk management is that both are essential for the success and protection of any organization. While compliance is necessary to ensure regulatory adherence and avoid potential legal consequences, risk management is necessary for the overall success of the organization. By identifying and mitigating risks, risk management helps a company avoid financial and reputational damage, which can be catastrophic. Without proper compliance, however, the organization risks running afoul of regulators, which can lead to fines, legal proceedings, and other negative outcomes. In sum, while compliance and risk management may have different priorities, both are vital for a successful and sustainable organization. - Risk management must escape the siloed nature of compliance to be effective.

To be effective, risk management must step out of the siloed nature of compliance. It means that departments, systems, and processes must communicate and work together to view potential risks comprehensively. Compliance departments often operate on their own, focusing on meeting established rules and regulations. However, risk management includes identifying and mitigating risks, both known and potential, to ensure overall organizational success. By integrating compliance and risk management, organizations can create a more comprehensive approach to risk management that will benefit the company as a whole. A clear distinction between compliance, hazard, control, and opportunity risks needs to be understood to ensure good risk management. It is crucial for the departments to work together and include processes to ensure proper compliance in their risk management plans. Both compliance and risk management are crucial for the success and protection of any organization. - Risk management plans should include processes for ensuring proper compliance.

To ensure the success of an organization, risk management plans should include processes that ensure proper compliance with regulations. While compliance and risk management are different, they are closely linked and share a common goal of protecting the organization. Integrating compliance processes into risk management plans can help to identify and mitigate potential risks related to non-compliance. It requires a collaborative effort between compliance and risk management teams, with a focus on communication and transparency. Additionally, risk management plans should include regular monitoring of compliance regulations and updates to ensure ongoing adherence. By including compliance processes in risk management plans, organizations can streamline their efforts and better protect themselves from potential risks. - Risk management encompasses a broad range of risks, while compliance is primarily focused on regulatory compliance.

As previously discussed, compliance and risk management are two critical components of organizational success. While compliance is focused on meeting established regulations, risk management takes a broader approach by identifying and mitigating various risks across the organization. Risk management encompasses a wide range of risks, including financial, operational, reputational, and more. It involves predicting and managing uncertainties that could hinder the organization’s ability to achieve its objectives. On the other hand, compliance is primarily focused on regulatory compliance and ensuring adherence to specific rules and regulations. While the two functions are closely related, it’s essential to recognize the difference between them and have strategies in place to effectively manage both compliance and risk. By understanding the range of risks that exist and working to mitigate them, organizations can better ensure their overall success and stability. - Risk management is about predicting and managing uncertainties, while compliance focuses on adherence to specific regulations.

One of the key differences between compliance management and risk management lies in their primary focus. While compliance management is all about following established rules and regulations, risk management is more concerned with predicting and managing potential uncertainties. A good risk manager is always looking ahead, anticipating potential threats and putting in place strategies to mitigate them before they can negatively impact the organization. Compliance managers, on the other hand, are more concerned with ensuring adherence to specific regulations and avoiding any legal or financial consequences of noncompliance. Both compliance and risk management are important for ensuring the success and protection of any organization, but they require different sets of skills and outlooks. By understanding the differences between these two functions, organizations can better position themselves to manage risk and remain compliant in an ever-changing regulatory landscape. - Both compliance and risk management are crucial for the success and protection of any organization.

In conclusion, compliance and risk management are essential to any organization’s success and protection. Compliance ensures adherence to regulatory guidelines and internal policies, while risk management identifies and mitigates potential risks that could impact the organization’s stability and longevity. It is essential for leadership teams and risk managers to understand the differences between compliance and risk management and how to bring them together effectively. By implementing proper risk management plans that include processes to ensure compliance, organizations can effectively predict and manage uncertainties while maintaining regulatory adherence. Both compliance and risk management must be given the necessary attention and resources to ensure the success and protection of the organization.

Roles and Responsibilities of Compliance Manager

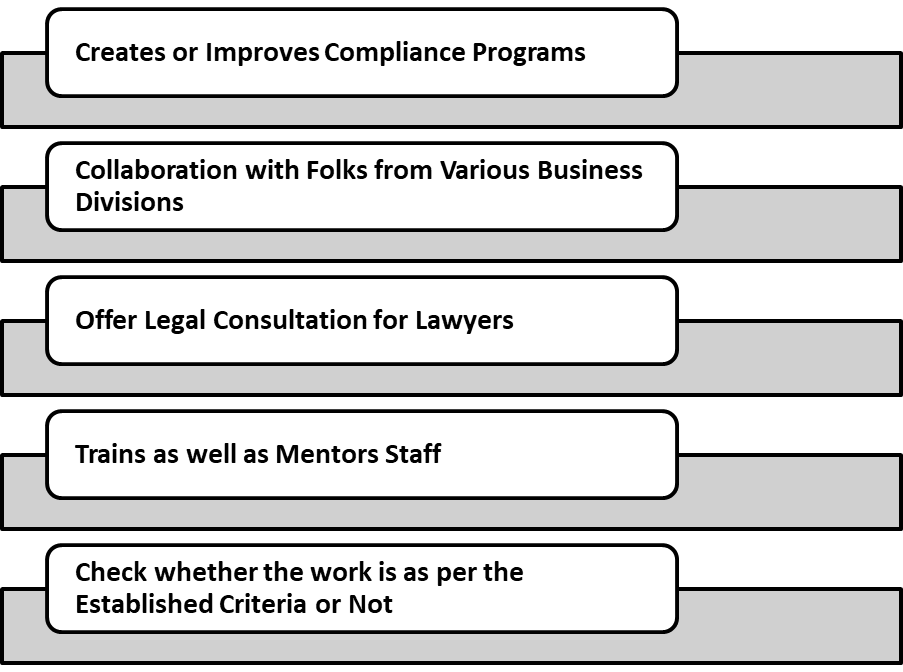

The roles and responsibilities of a compliance manager consist of the following–

- Provide assistance or take charge of initiatives aimed at creating or improving compliance programs.

- Precisely identify and dependably convert research compliance goals into business objectives that can be incorporated into an effective business procedure.

- Collaborate with colleagues from various business divisions and supporting departments, such as Regulatory, Human Resources, Finance, Quality Control and Assurance, Research and Development, and Environmental Health and Safety, while working on different assignments.

- Offer legal consultation exclusively for lawyers or assist in the delivery of legal consultation concerning the duties of the Company considering its particular business environment. Convert this guidance into attainable business goals that can be integrated into a robust business procedure.

- Organizes as well as supervises both the execution along with monitoring of adhering to zoning regulations.

- Manages the adherence to zoning, engineering, and environmental regulations while operating on shared premises.

- Oversees and assesses the performance of the employees responsible for ensuring adherence to zoning regulations.

- Trains as well as mentors staff

- Checks if the work complies with the established criteria.

- Checks the validity of zoning regulations, plans, and conditions by conducting on-site inspections.

- Provides support in developing work plans, conducting performance reviews, and taking disciplinary measures.

- Reaches agreements regarding adherence with all parties involved.

- Review marketing initiatives on a frequent basis

- Manage a team of analysts in order to accomplish compliance assurance

- Provide annual training to concerned departments

Future Opportunities and Skills for Professionals

Looking ahead to the future, compliance managers can expect to see some significant changes in their roles and responsibilities. As technology continues to advance, compliance managers will need to stay up-to-date with new and emerging trends in areas like data privacy, cybersecurity, and artificial intelligence[1]. They will also need to develop skills in areas like data analysis, risk assessment, and crisis management, which will help them to identify better and mitigate potential compliance issues. Additionally, compliance managers will have to work closely with other departments, including legal, finance, and HR, to ensure that everyone is aligned on compliance goals and objectives. Overall, the future looks bright for compliance managers, who can expect to play an increasingly vital role in ensuring the integrity and success of their organizations.

How Compliance Managers Support Health and Safety Regulations in the Workplace?

Compliance managers play a pivotal role in ensuring that health and safety regulations are met in the workplace. They work collaboratively with other departments to design and implement policies and procedures that meet regulatory guidelines. Compliance managers conduct risk assessments and audits, identifying potential hazards in the workplace and recommending corrective actions to mitigate risks. Their mandate goes beyond meeting regulatory requirements as they ensure that employees receive training on safety protocols and monitor their adherence to them. Compliance managers also oversee incident reporting and investigation, which allows for the identification of problem areas and the implementation of corrective measures to prevent a recurrence. Ultimately, the work of a compliance manager helps maintain a safe as well as healthy work environment for all stakeholders, contributing to the well-being of the company and its employees. If you want to bring someone on board for the compliance manager role, contact a recruitment consulting firm that provides legal hiring services.

The Final Words

The compliance manager is responsible for ensuring that the company is functional within ethical and regulatory standards. The future of compliance managers seems to be promising and full of hope. Organizations blessed with capable and efficient compliance managers are flourishing well.

Read our Article:Product Design Manager: Job Description, Responsibilities and Career